Medical Insurance Market Trends, Share Opportunities and Forecast By 2029

Executive Summary Medical Insurance Market Research: Share and Size Intelligence

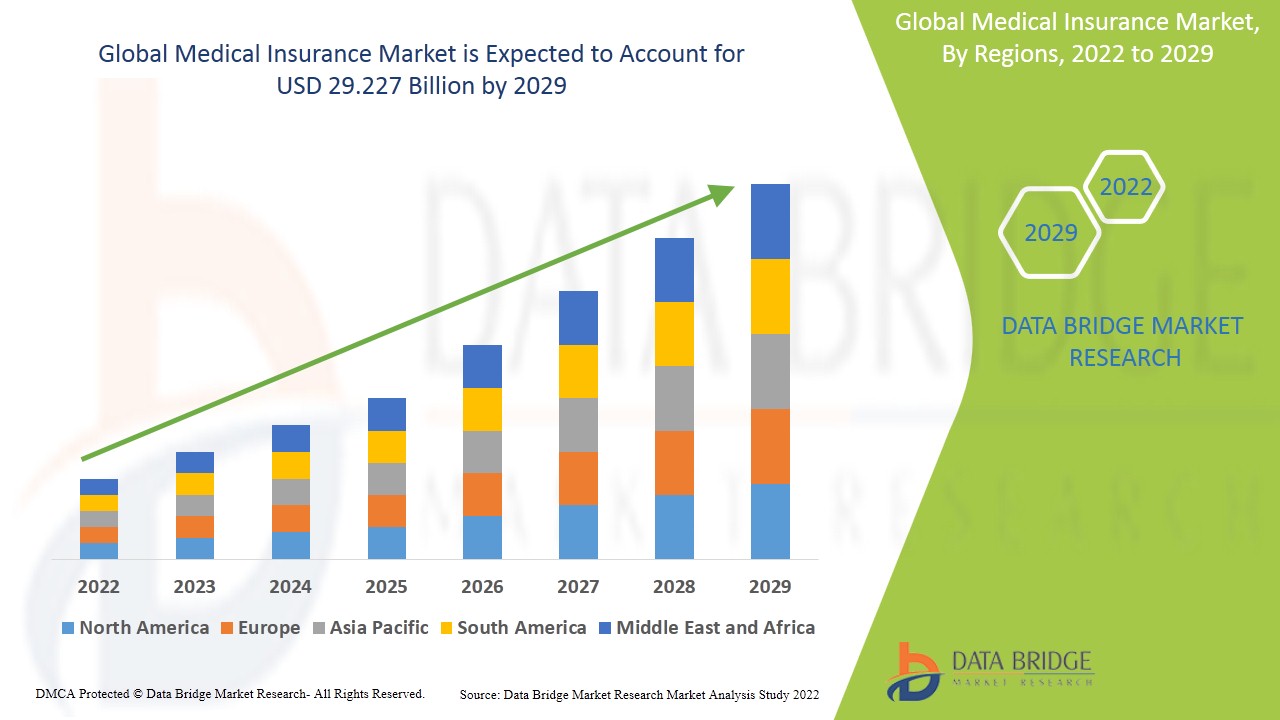

Data Bridge Market Research analyses that the medical insurance market to account USD 29.227 billion by 2029 growing at a CAGR of 10.30% in the forecast period of 2022-2029.

Best-practice models and research methodologies have been employed in the reliable Medical Insurance Market report for a complete market analysis. It is a completely informative and proficient report that highlights primary and secondary market drivers, market share, leading segments and geographical analysis. With this business report, it has been assured that an absolute knowledge and insights about the new regulatory environment which are most suitable for their organization are provided. Utilization of integrated approaches combined with most up-to-date technology for building this world class marketing report makes it unrivalled. The trends in consumer and supply chain dynamics are acknowledged in Medical Insurance Market report to accordingly interpret the strategies about marketing, promotion and sales.

With the market info provided in the global Medical Insurance Market report, it has become easy to gain global perspective for the international business. Focus groups and in-depth interviews are included for qualitative analysis whereas customer survey and analysis of secondary data has been carried out under quantitative analysis. This market research report acts as a very significant constituent of business strategy. This market report is a definite study of the Medical Insurance Market industry which explains what the market definition, classifications, applications, engagements, and global industry trends are. Medical Insurance Market report proves to be a sure aspect to help grow the business.

Find out what’s next for the Medical Insurance Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market

Medical Insurance Market Dynamics

**Segments**

- **Type**

- Health Insurance

- Critical Illness Insurance

- Income Protection Insurance

- Other

- **Provider**

- Public

- Private

- **Coverage**

- Inpatient Treatment

- Outpatient Treatment

- Medical Assistance

- Others

- **End-User**

- Minors

- Adults

- Seniors

The global medical insurance market is segmented based on type, provider, coverage, and end-user. In terms of type, the market is categorized into health insurance, critical illness insurance, income protection insurance, among others. Health insurance dominates the market due to the increasing prevalence of chronic diseases and the rising awareness regarding the importance of health coverage. When it comes to providers, the market is divided into public and private entities. Public insurance providers are usually government-run, while private insurance companies are profit-driven entities. The coverage segment includes inpatient treatment, outpatient treatment, medical assistance, and other services. In terms of end-users, the market caters to minors, adults, and seniors, with different insurance options customized for each group's specific needs.

**Market Players**

- UnitedHealth Group

- Anthem Insurance Companies, Inc.

- Aetna Inc.

- Allianz Care

- AXA

- Aviva

- AIA Group Limited

- Apollo Munich Health Insurance Company Ltd.

- ASSICURAZIONI GENERALI S.P.A

The global medical insurance market is highly competitive, with major players striving for market dominance through strategies like mergers, acquisitions, and partnerships. Companies such as UnitedHealth Group, Anthem Insurance Companies, Aetna Inc., and Allianz Care are prominent players in the market with a wide range of offerings and a strong global presence. Other key players like AXA, Aviva, and AIA Group Limited are also making significant contributions to the market growth by offering innovative insurance products and expanding their market reach. Regional players like Apollo Munich Health Insurance Company Ltd. and ASSICURAZIONI GENERALI S.P.A contribute to the market's diversity by catering to specific regional needs and preferences.

The global medical insurance market is witnessing significant growth driven by various factors such as increasing healthcare costs, rising awareness about the benefits of insurance coverage, and the growing prevalence of chronic diseases worldwide. The market is expected to continue expanding as more individuals and organizations recognize the importance of having financial protection against unexpected medical expenses. Furthermore, the COVID-19 pandemic has underscored the importance of having robust health insurance coverage, leading to a surge in demand for medical insurance products across different demographics.

One key trend shaping the medical insurance market is the shift towards value-based care and preventive health services. Insurance providers are increasingly focusing on promoting wellness programs, early disease detection, and lifestyle management initiatives to proactively improve the health outcomes of their policyholders. This approach not only benefits the insured individuals by reducing the risk of developing serious health conditions but also helps insurance companies manage their claims costs more effectively. As a result, we can expect to see continued investments in preventive healthcare services and innovative wellness solutions by insurance players to differentiate themselves in the competitive market landscape.

Another emerging trend in the medical insurance market is the increasing adoption of digital technologies to enhance customer experience and streamline operational processes. Insurers are leveraging tools such as artificial intelligence, data analytics, and telemedicine to offer personalized insurance solutions, quick claims processing, and round-the-clock assistance to policyholders. This digital transformation is not only improving the overall efficiency of insurance operations but also enabling insurers to better understand their customers' evolving needs and preferences. As technology continues to advance, we can anticipate further innovations in digital health insurance offerings, such as wearable devices for health monitoring and telehealth consultations, to become mainstream in the market.

Moreover, the regulatory landscape plays a crucial role in shaping the dynamics of the medical insurance market. Governments worldwide are implementing policies and regulations to ensure the financial stability and consumer protection within the insurance industry. Compliance with regulatory requirements and adherence to ethical standards are paramount for insurance providers to gain trust and credibility among consumers. In this context, market players need to stay abreast of evolving regulatory guidelines and adjust their business practices accordingly to maintain a competitive edge and uphold their reputation in the market.

In conclusion, the global medical insurance market presents lucrative opportunities for players across segments, including health insurance, critical illness insurance, and income protection insurance. By aligning their strategies with key market trends such as value-based care, digital innovation, and regulatory compliance, insurance providers can position themselves for sustained growth and success in this dynamic and competitive industry landscape.The global medical insurance market continues to evolve and adapt to various trends and drivers that shape its landscape. One important aspect influencing the market is the increasing focus on personalized insurance solutions and value-based care. Insurance providers are moving towards offering tailor-made packages that cater to the specific needs and preferences of individual policyholders. This shift underscores the industry's commitment to enhancing customer experience and ensuring that insurance coverage aligns with the healthcare requirements of diverse demographics.

Furthermore, the integration of digital technologies has become a game-changer in the medical insurance sector. Insurers are leveraging artificial intelligence, data analytics, and telemedicine to streamline their operational processes, improve the efficiency of claims processing, and provide round-the-clock customer support. The adoption of digital solutions not only enhances the overall customer experience but also enables insurers to gain valuable insights into consumer behavior and market trends. As technology continues to advance, we can expect to see a proliferation of innovative digital health insurance offerings that elevate the standard of care and service delivery within the industry.

Moreover, regulatory compliance and adherence to ethical standards remain fundamental pillars that govern the operations of insurance providers in the global market. Governments worldwide are imposing stringent regulations to ensure financial stability, consumer protection, and ethical business practices within the insurance sector. Market players need to navigate this complex regulatory environment by staying informed about evolving guidelines and standards, thereby fostering trust and credibility among consumers. Compliance with regulatory requirements is non-negotiable for insurers aiming to maintain a competitive edge and establish a solid reputation in the highly competitive medical insurance market.

In conclusion, the global medical insurance market is a dynamic and competitive industry that offers significant growth opportunities for insurers. By leveraging key trends such as personalized insurance solutions, digital innovation, and regulatory compliance, insurance providers can differentiate themselves, attract new customers, and drive sustained growth in the evolving healthcare landscape. Embracing these trends and aligning business strategies with the changing market dynamics will be essential for insurers to navigate challenges, seize emerging opportunities, and thrive in the ever-evolving global medical insurance market.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/global-medical-insurance-market/companies

Master List of Market Research Questions – Medical Insurance Market Focus

- How large is the addressable market in terms of volume?

- What is the average revenue per user (ARPU)?

- How many startups are entering the Medical Insurance Market yearly?

- What are the growth drivers in developing economies?

- What is the impact of e-commerce on this Medical Insurance Market?

- What consumer preferences are influencing product design?

- Which demographic segments are being targeted?

- How are supply chains evolving in this Medical Insurance Market?

- Which regions are witnessing price wars?

- What is the typical lifecycle of a product in this Medical Insurance Market?

- How sustainable is the production process in this Medical Insurance Market industry?

- Which companies have increased R&D spending?

- What impact does inflation have on demand?

- How do marketing strategies vary globally Medical Insurance Market?

Browse More Reports:

Global Sorbic Acid Market

Global Specialty Crop Market

Global Specialty Oleochemicals Market

Global Specialty Polystyrene Resin Market

Global Spelt Milk Market

Global Spin Mops Market

Global Spinal Cord Stimulators Market

Global Spinal Cord Tumor Market

Global Spondylosis Treatment Market

Global Sputtering Targets and Evaporation Materials Market

Global Status Epilepticus Treatment Market

Global Steel Fiber Market

Global Sterile Filtration Market

Global Stick Packaging Market

Global Liquid Feed Protein Supplements Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness