Hotel Room GST in India Slashed to 5%: What It Means for Travelers & Hoteliers

Introduction

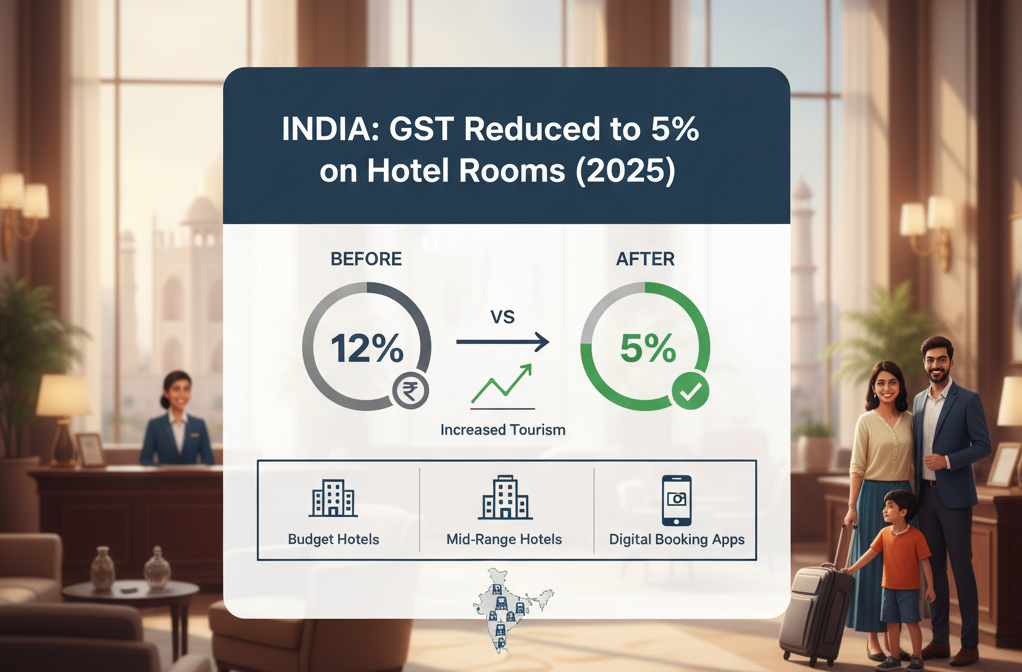

India’s hospitality sector has undergone a major tax restructuring with the government’s decision to reduce GST on hotel rooms priced up to ₹7,500 to just 5%. This bold move is part of the broader GST rationalization intended to stimulate domestic tourism, make hotel stays more affordable, and bring greater clarity to the tax framework.

Before this reform, hotel rooms within the same tariff range attracted 12% GST with Input Tax Credit (ITC). Under the new structure, these rooms now fall under the 5% GST slab without ITC, making hotel stays cheaper for guests while altering cost structures for hoteliers.

This comprehensive guide explains the new GST structure, its benefits and challenges, the impact on different hotel segments, traveler advantages, pricing effects, hotel profitability, and how hotels can adapt strategically.

Understanding the New GST Structure for Hotels

To simplify how the new GST rates apply, here is the updated breakdown:

Updated GST Rates for Hotel Rooms in India

| Room Tariff (per night) | Applicable GST Rate | Eligible for ITC? | Who It Applies To |

|---|---|---|---|

| Up to ₹7,500 | 5% GST | No ITC | Budget & mid-range hotels |

| Above ₹7,500 | 18% GST | ITC available | Luxury & star hotels |

This distinction ensures affordable travel options continue to expand while luxury hotels maintain financial sustainability through ITC.

Why the Government Reduced GST on Hotel Rooms

The hospitality industry plays a crucial role in job creation, tourism, consumption, and economic growth. With the new GST reduction, the government hopes to:

1. Boost Domestic Tourism

A 5% GST finally makes short trips, longer stays, and weekend tours more affordable for middle-income families, solo travelers, and business visitors.

2. Support Budget and Mid-Range Hotels

Most hotels across India fall within the ₹1,000–₹6,500 tariff range. Reducing GST helps increase occupancy across this core segment.

3. Make Indian Travel More Competitive

This reform aligns hotel taxes in India more reasonably with global tourism economies, helping attract more international travelers.

4. Simplify the GST Regime

A cleaner structure ensures hotels face fewer compliance challenges, and guests benefit from clearer billing.

5. Encourage Hospitality Investments

Lower room taxes drive demand, which may encourage small and mid-size hoteliers to expand capacity.

Impact of 5% GST on Different Hotel Segments

The reform affects hotel categories differently. Here’s a deeper look:

1. Budget & Mid-Range Hotels (Up to ₹7,500)

Benefits

-

Lower room rates attract more guests.

-

Higher occupancy rates due to overall affordability.

-

Increased demand from backpackers, families, and domestic business travelers.

Challenges

-

Hotels in this slab cannot claim Input Tax Credit (ITC).

-

Operational expenses such as furniture, cleaning supplies, renovation materials, linens, and utilities still incur GST without any claimable credits.

-

Reduced ITC may squeeze profit margins, especially for small hotels.

Overall Impact

Higher occupancy is expected to balance out profit challenges, but hotels need strong revenue strategies.

2. Luxury Hotels & Star Properties (Above ₹7,500)

Benefits

-

Continue enjoying 18% GST with ITC, allowing them to offset a large portion of their operating expenses.

-

Luxury hotels often deal with larger input costs, making ITC crucial.

Challenges

-

Lower GST in budget hotels creates competitive pressure.

-

Many mid-range customers may avoid upgrading to a higher tariff category due to the tax gap.

Overall Impact

Luxury hotels will remain competitive through branding, premium experiences, and service standards.

How Travelers Benefit from the GST Reduction

This GST reform has direct advantages for guests booking stays at budget and mid-segment hotels:

1. Cheaper Room Rates

A hotel room previously priced at ₹5,000 + 12% GST = ₹5,600

Now becomes: ₹5,000 + 5% GST = ₹5,250

Guests save ₹350 per night.

2. Affordable Travel for Families

Travel expenses drop significantly when booking multiple rooms or longer stays.

3. Growth in Domestic Tourism

Many tourists who avoided hotels due to high taxes can now travel more often.

4. Better Value-for-Money Options

More hotels will design competitive packages, free-breakfast deals, and discounted stays.

5. Business Travel Becomes Cheaper

Companies managing employee travel benefit from reduced accommodation expenses.

How Hoteliers Are Affected: The Operational View

While the reform is great for travelers, hoteliers must realign their operational strategies.

1. Loss of ITC Means Higher Internal Costs

Hotels must pay GST on:

-

Raw materials

-

Electricity and utility services

-

Cleaning products

-

Maintenance and repairs

-

Capital goods like furniture & equipment

With the 5% GST slab not offering ITC, all these become added expenses.

2. Occupancy Must Compensate for Margin Pressure

Hotels need:

-

Better pricing strategies

-

Stronger OTA presence

-

Upselling tactics

-

Revenue management tools

Higher occupancy can stabilize profitability.

3. Competitive Pricing Becomes Critical

Hotels must maintain a balance between affordable room rates and sustainable profit margins.

4. Operational Efficiencies Become Essential

To offset the lack of ITC, hotels should focus on:

-

Cost reduction

-

Energy-efficient operations

-

Bulk procurement

-

Technology adoption

-

Automation in front desk & housekeeping

How Hotels Can Adapt Successfully to the New GST Regime

To turn this reform into an advantage, hotels can follow the strategies below:

1. Optimize Room Pricing

Hotels should:

-

Use dynamic pricing

-

Introduce seasonal discounts

-

Implement weekday vs weekend pricing

-

Create package deals

This ensures steady occupancy throughout the year.

2. Adopt Smart Technology Platforms

Modern hotel software tools like:

-

Channel Managers

-

Revenue Management Systems

can automate GST billing, optimize pricing, and streamline operations.

3. Strengthen Online Presence

Hotels should focus on:

-

Listing on OTAs

-

Website booking engines

-

Social media marketing

-

Google Business Profile optimization

This attracts more guests at minimal cost.

4. Upsell Smartly

Hotels can offer:

-

Late check-outs

-

Transfers

-

Meal upgrades

-

Laundry services

-

City tours

These boost revenue even when room rates stay low.

5. Improve Guest Experience

With stronger competition, experience becomes the real differentiator:

-

Clean rooms

-

Quick service

-

Smarter check-in

-

Complimentary add-ons

-

Personalized communication

Future Outlook of the Hospitality Industry

The GST reduction is expected to reshape India’s hotel industry in the coming years.

1. Increased Travel Across India

Affordable stays encourage tourism in Tier-II and Tier-III cities.

2. Growth in Budget Hotel Chains

Brands within the ₹2,000–₹6,000 bracket will see massive expansion.

3. Small Hotels Will Upgrade

Independent hotels may remodel and reposition themselves for better occupancy.

4. Overall Tourism Industry Benefits

Tour operators, local restaurants, cab services, and travel guides will see an increase in business.

FAQs (6 FAQs Before Conclusion)

1. What is the new GST rate on hotel rooms in India?

Hotel rooms priced up to ₹7,500 per night are now taxed at 5% GST.

2. Can hotels charge 5% GST with ITC?

No. Hotels under the 5% slab cannot claim Input Tax Credit (ITC).

3. What GST is applicable on luxury hotel rooms?

Rooms priced above ₹7,500 per night attract 18% GST, and ITC is allowed.

4. Is it now cheaper for guests to book hotel rooms?

Yes. The shift from 12% to 5% GST reduces total stay costs, making travel more affordable.

5. Does the GST reduction affect hotel pricing strategy?

Yes. Hotels must rework pricing, improve occupancy, and use revenue management tools to balance margins.

6. How can hotels manage costs under the no-ITC rule?

Hotels can adopt automation, optimize procurement, reduce wastage, and use technology to maintain profitability.

Conclusion

The reduction of GST on hotel rooms to 5% for tariffs up to ₹7,500 is a significant turning point for India’s tourism and hospitality industry. While the reform greatly benefits travelers by lowering stay expenses and encouraging tourism, hoteliers must adapt strategically due to the removal of ITC.

Budget and mid-range hotels stand to gain in occupancy, while luxury hotels continue relying on ITC to manage their advanced service standards. For hotels to thrive in this new environment, they must invest in technology, dynamic pricing, guest experience, and operational efficiency.

This new GST regime is expected to make travel more accessible, support the growth of India’s domestic tourism market, and elevate the overall hospitality experience across the country.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness