Smart Strategies for Securing the Best Debt Consolidation Loans

Managing multiple debts can feel overwhelming with different due dates, varying interest rates, and constant financial pressure. Thankfully, instant debt consolidation loans offer a practical way to regain control. By merging all your debts into one manageable payment, you simplify your financial life and potentially lower your interest costs. In this blog, we’ll explore how to apply for a debt consolidation loan online, what to look for, and how to find the best debt consolidation loans for your unique needs.

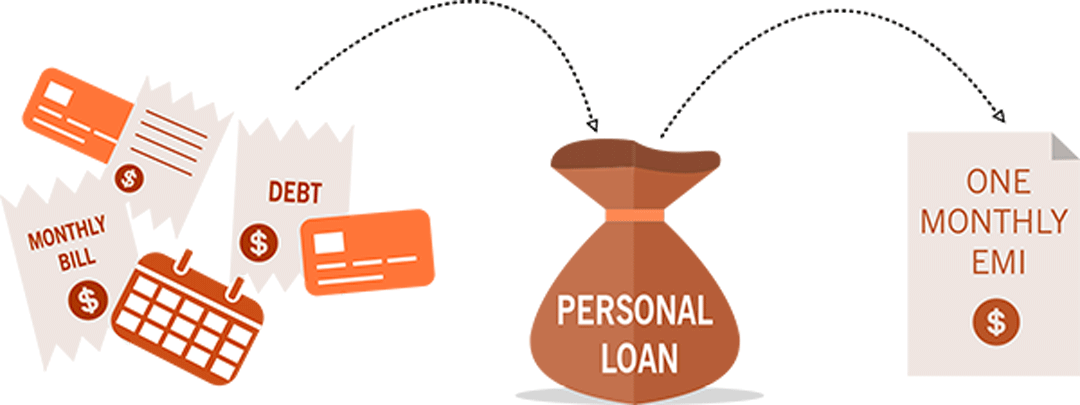

What Is a Debt Consolidation Loan?

A debt consolidation loan is a personal loan used to pay off multiple debts such as credit cards, medical bills, or other loans. Instead of juggling several payments, you make one single monthly payment to a new lender.

Why People Choose Debt Consolidation

-

Lower interest rates compared to credit cards

-

Reduced monthly payments depending on loan terms

-

Simplified finances, making it easier to avoid late fees

-

Faster payoff, if you choose a shorter loan term

Instant Debt Consolidation Loans: Are They Reliable?

Many lenders now offer instant debt consolidation loans, giving you quick approval decisions sometimes within minutes. While these loans provide speed and convenience, it’s important to choose reputable lenders.

Benefits of Instant Approval

- Quick decisions prevent delays in paying off high-interest accounts

- Faster processing helps you start saving sooner

- Ideal for people with urgent financial needs

What to Watch Out For

Not all instant offers are equal. Some may come with higher interest rates or hidden fees. Always compare lenders and read the fine print before accepting an offer.

How to Apply for a Debt Consolidation Loan Online

Applying for a loan online has never been easier. Most platforms offer a seamless, guided process that takes just a few minutes.

Step-by-Step Application Guide

-

Check your credit score

A higher score typically results in a lower interest rate. -

Gather financial documents

You may need proof of income, identification, and details about your existing debts. -

Pre-qualify with lenders

Many lenders allow you to check your rates without affecting your credit score. -

Compare loan options

Look at APR, repayment terms, fees, and customer reviews. -

Submit your application

Fill out the form, upload documents, and wait for approval—often instant. -

Use the loan to pay off debts

Some lenders even pay creditors directly for added convenience.

Finding the Best Debt Consolidation Loans

Not every loan works for everyone. The best debt consolidation loans depend on your financial profile, goals, and credit rating.

Key Features to Compare

-

APR (Annual Percentage Rate)

This includes interest and fees. Lower is always better. -

Loan Term Length

Shorter terms save money on interest, but longer terms lower monthly payments. -

Fees

Watch for origination fees, prepayment penalties, or late payment charges. -

Funding Speed

Some lenders fund within 24 hours ideal for urgent situations. -

Customer Support

A supportive lender makes your experience smoother.

Best Options for Different Borrowers

- Good Credit: You’ll qualify for lower interest rates and better terms.

- Fair Credit: Look for lenders specializing in mid-range scores.

- Bad Credit: Some lenders still offer options but expect higher rates.

- High Debt Levels: Choose a lender offering large loan amounts.

Smart Tips Before Taking a Consolidation Loan

- Create a new budget to prevent taking on more debt.

- Avoid closing old accounts immediately, as this could affect your credit score.

- Use the loan only for debt payoff, not new purchases.

- Check lender reputation using online reviews and ratings.

Final Thoughts

Debt consolidation can be a powerful financial tool especially when you choose wisely. Whether you need instant debt consolidation loans for quick relief or want to apply for a debt consolidation loan online to compare the best offers, the right option can help you simplify payments and save money. Take time to research the best debt consolidation loans, understand the terms, and commit to a more organized financial future. With the right approach, financial freedom is closer than you think.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness