Insurtech Market Analysis, Growth & Forecast Report, 2032 | UnivDatos

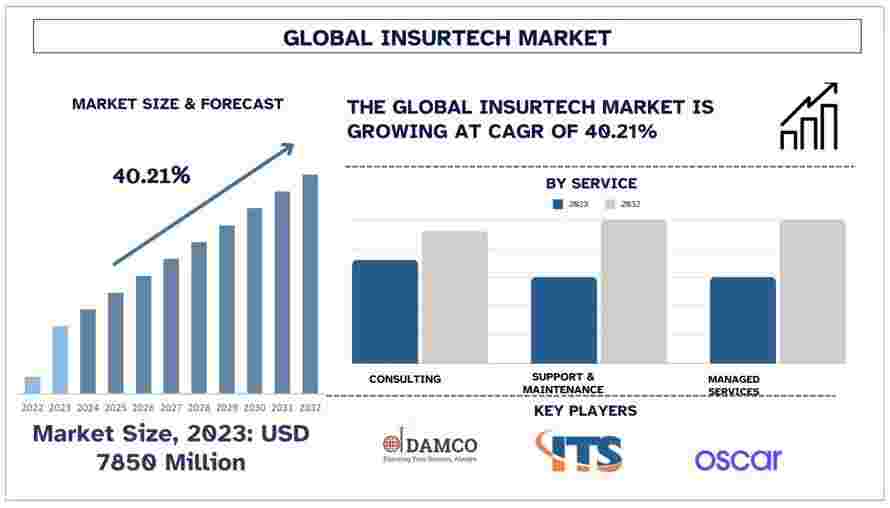

According to the UnivDatos analysis, growing investments in the digitalization for improving operational efficiency, the sector will surge in demand for the Global Insurtech market, which will drive the global scenario of the “Global Insurtech” report; the global market was valued at USD 7850 million in 2023, growing at a CAGR of 40.21% during the forecast period from 2024 - 2032 to reach USD million by 2032.

The aviation industry in the North American region has been one of the major markets adopting Insurtech due to the higher availability of insurance companies as well as a vast number of customers opting both for general and life insurance in the region. With the high presence of the respective insurance providers, the demand for insurtech in the region has extensively grown further leading to the requirement of digital services through insurtech supporting the market growth.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/insurtech-market?popup=report-enquiry

Insurtech Market Overview in North America:

North America is Expected to Hold Major Market Share During Forecast Period

North America Insurtech market has grabbed a sizeable market share across the globe. North America has gained significant growth due to advanced infrastructure, an innovative ecosystem, consumer demand for digital solutions, enhanced government support, and a vast insurance market. North America has a vast and mature insurance market, of which healthcare, automotive, business, retail sectors, etc., are prominent. Of these, the US, and Canada are some of the prominent countries that have held a major position for Insurtech in the region. For instance, according to the Allianz Group, in 2023, the US continued to dominate the global healthcare insurance market with a total of around two-thirds of the global premium. Considering the high focus of the customers for insurance for both life and general insurance, the region is further anticipated to require increased investment in Insurtech services further improving the market growth during 2024-2032.

Additionally, the region is also a pioneer in terms of digitalization in the insurance sector, which has noticeably assisted in the development and integration of predictive analytics, chatbots, AI, etc., and paved the way for the Insurtech market.

Growing Demand and Industry Trends:

Implementation and usage of data analytics is one of the crucial developments for Insurtech services providers. Data analytics services offer improved speed, accuracy, and reliability of insurance forecasts. As predictive analytics offer various benefits such as risk assessment and underwriting, insurance pricing, insurance claim settlement, proactive prevention of claim cases, insurance product optimization, delivering a personalized experience, financial planning analysis, etc., insurance companies are moving towards integrating predictive analytics services to improve their optimal decision-making process.

With the rising need for improving the insurance companies working process and product offering along with the improvement of operational efficiency the demand for predictive analytics is further anticipated to rise during 2024-2032.

Future Prospects and Opportunities:

An increasing number of insurance companies across the globe opting for digital solutions to improve their services is one of the key factors that would increase the confidence among other players further requiring Insurtech services in the long run. In recent years many of the leading insurance players have launched their various digital services in line with their strategic goal to improve the customer experience. For instance, in 2024, Allianz Partners announced the launch of the Allyz mobile app for digital assistance and services to travelers for insurance benefits in Germany and France.

In another instance, in 2023, Digital First Insurance launched its mobile app for making insurance transactions easier with the integration of AI and chatbot.

Considering the factors the demand for the Insurtech market would exhibit growth during 2024-2032.

Click here to view the Report Description & TOC https://univdatos.com/reports/insurtech-market

Conclusion:

In conclusion, North America's Insurtech market reflects a dynamic and evolving landscape supported by government investment, industry collaboration, and technological innovation. As the region continues strengthening its insurance industry and its effectiveness through investment increases, regulatory frameworks, and strategic partnerships, it is well-positioned to navigate challenges and capitalize on emerging opportunities in the insurance sector.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness