Best Modern Fintech App Development for a Cashless Economy

The world is moving rapidly toward a cashless economy. From contactless payments to mobile banking, digital wallets, wealth management apps, and instant UPI transfers, fintech technology has transformed how people handle their finances. As consumers demand faster, safer, and more convenient ways to transact, businesses must embrace modern fintech solutions to stay competitive. This growing shift highlights the importance of partnering with a capable finance app development company that understands the evolving financial landscape and delivers cutting-edge digital products.

A cashless economy is no longer just a trend—it is becoming the global standard. Whether it's retail stores, eCommerce businesses, healthcare organizations, educational institutions, or government services, digital payments now play a vital role in driving economic efficiency. To support this transformation, fintech applications must be built with advanced security, seamless usability, and scalable architecture.

Why the World Is Shifting Toward a Cashless Economy

The cashless economy offers unmatched benefits for businesses, consumers, and governments. Digital transactions are faster, safer, and far more transparent than traditional cash-based processes. Some key reasons behind this shift include:

-

Convenience: Users can make payments anytime, anywhere.

-

Speed: Instant transfers reduce wait times and improve customer satisfaction.

-

Security: Digital payments minimize theft, fraud, and human error.

-

Transparency: Digital records help maintain financial clarity.

-

Reduced Costs: Businesses spend less on cash handling.

-

Global Connectivity: Cashless systems support cross-border transactions easily.

To build the financial infrastructure of tomorrow, companies need modern fintech applications that integrate seamlessly with banks, payment systems, and digital platforms.

How Fintech App Development Powers the Cashless Revolution

Fintech applications play a critical role in enabling digital transactions and ensuring secure money movement. Modern fintech systems are equipped with advanced technologies such as AI, blockchain, biometrics, encryption, real-time analytics, and cloud computing.

1. Digital Payment Solutions

Apps supporting QR codes, NFC payments, UPI-based transfers, cards, and wallet systems make payments hassle-free. Businesses rely on fintech apps to provide secure, frictionless transactions to customers.

2. Mobile Banking

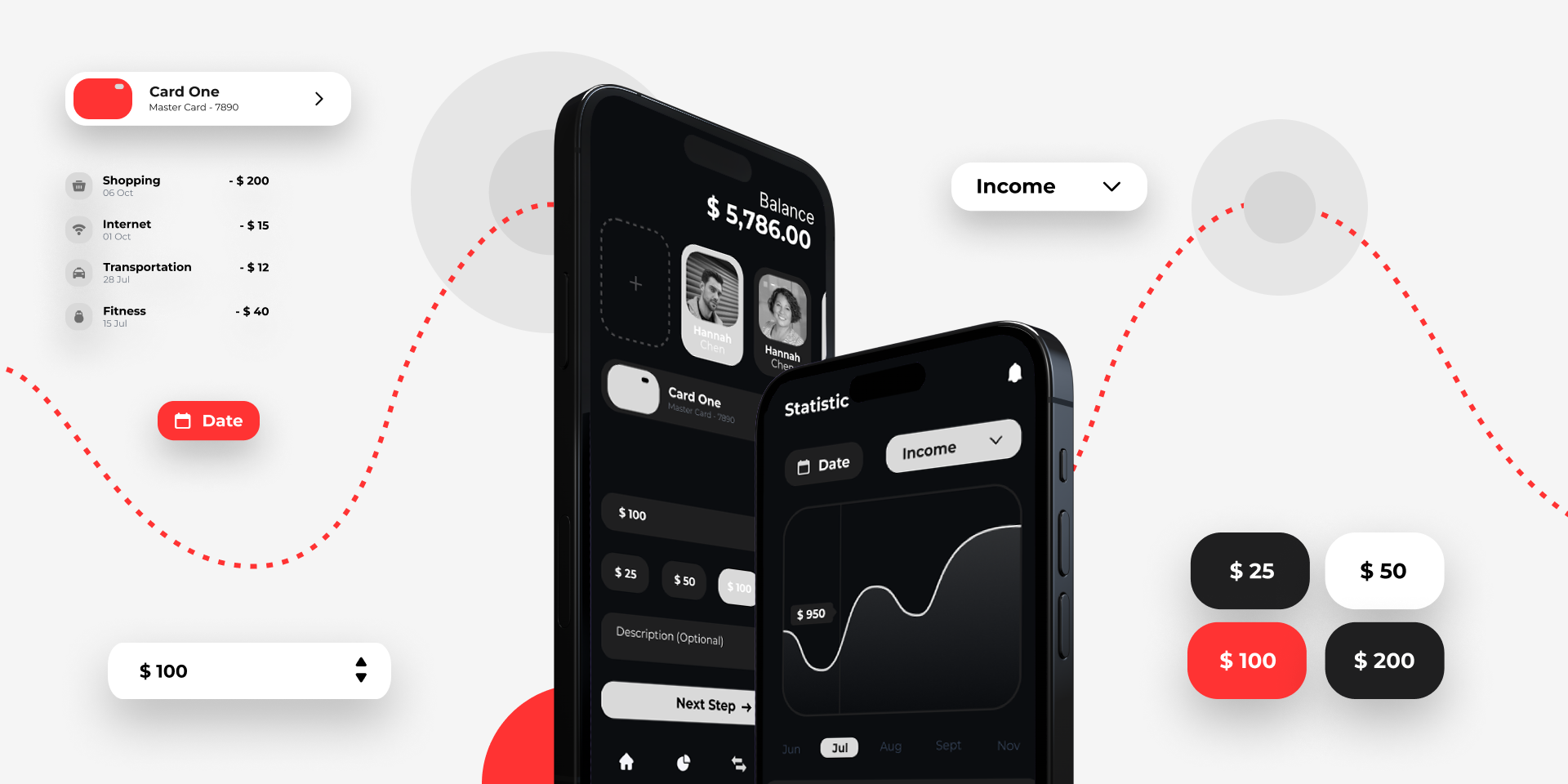

Mobile banking apps allow users to check balances, transfer funds, track expenses, apply for loans, and invest—all through an intuitive digital interface.

3. Digital Wallets

Wallet platforms like Google Pay, Apple Pay, Paytm, and many others allow users to store funds digitally and make instant payments.

4. Contactless Payments

NFC technology allows users to pay with a tap—no cash, no card swiping, no physical contact.

5. Peer-to-Peer Payment Apps

Apps like Venmo, Cash App, PhonePe, and others have made person-to-person money transfers incredibly simple and instant.

6. Blockchain-Based Systems

Blockchain technology enhances financial transparency and security through decentralized transaction records, smart contracts, and crypto wallets.

7. AI-Powered Solutions

AI helps detect fraud, automate customer support, predict spending patterns, and personalize financial recommendations.

Key Features Required in Modern Fintech Apps

To support a cashless economy, modern fintech apps must include several mission-critical features:

High-End Security

-

Multi-factor authentication

-

Biometrics (face & fingerprint recognition)

-

End-to-end encryption

-

Secure API gateways

-

Real-time fraud detection

Regulatory Compliance

Fintech apps must follow strict financial regulations like KYC, AML, PCI-DSS, and GDPR. This helps maintain legal compliance and user trust.

Smooth User Experience

An intuitive and responsive design ensures users can complete transactions effortlessly without confusion.

Scalable Architecture

Cloud-powered systems allow apps to handle large volumes of simultaneous transactions securely.

Instant Payments & Real-Time Notifications

Users expect instant alerts for every transaction. Real-time updates improve trust and transparency.

Analytics & Reporting Tools

Advanced analytics help businesses track customer behavior, monitor performance, and gain insights.

Industries Thriving in a Cashless Economy with Fintech Apps

Fintech innovation benefits countless industries, including:

-

Retail & eCommerce

-

Healthcare

-

Education

-

Real Estate

-

Transportation

-

Food Delivery Services

-

Travel & Tourism

-

Banking & Financial Services

-

Insurance

Every industry that handles payments or financial operations heavily relies on modern fintech technology.

Why You Need a Professional Fintech Partner

Building a secure and reliable fintech app requires technical expertise, financial knowledge, and compliance experience. Partnering with an expert fintech software development company ensures your app is built with advanced features, strong security protocols, and a future-ready architecture.

Benefits of choosing a professional fintech partner include:

-

End-to-end development

-

Expert UI/UX design

-

Advanced security implementations

-

Faster time-to-market

-

Scalable and reliable infrastructure

-

Continuous support and maintenance

-

Integration of modern technologies

-

Cost-efficient development

A skilled team understands how to create applications that meet industry standards and deliver a smooth financial experience for users.

Technologies Transforming Cashless Financial Ecosystems

1. Blockchain

Enables transparency, decentralization, and tamper-proof transactions.

2. Artificial Intelligence

AI improves fraud detection, customer service, and financial forecasting.

3. Machine Learning

ML algorithms analyze user behavior and help personalize financial services.

4. Cloud Computing

Cloud platforms ensure high availability, performance, and scalability.

5. Big Data

Analyzes massive financial datasets to generate insights and predictive models.

6. IoT Payments

Smartwatches, wearables, and connected devices can now make payments automatically.

Role of Fintech Development Services in Building Cashless Systems

To bring all these technologies together, businesses rely on professional fintech development services that provide:

-

Custom fintech solution development

-

Wallet and payment gateway integration

-

Banking app development

-

POS system integration

-

Blockchain-based fintech solutions

-

AI and ML integrations

-

Financial data analytics systems

-

App security enhancement

-

Cloud migration for fintech systems

These services help businesses adopt cashless solutions seamlessly and stay competitive in the digital market.

Fintech App Development Process for Cashless Platforms

A strong development process ensures the app performs smoothly and remains secure.

1. Research & Requirement Analysis

Studying the target audience, payment behavior, and app purpose.

2. UI/UX Wireframing

Designing an intuitive interface for effortless navigation.

3. Backend Development

Building highly secure architecture and integrating APIs.

4. Security Integration

Implementing encryption, authorization, and compliance features.

5. Testing

Conducting performance, penetration, and security tests.

6. Deployment

Launching the app on targeted platforms with optimized performance.

7. Maintenance & Updates

Ensuring smooth functioning and adding new features regularly.

Benefits of Fintech Apps for a Cashless Society

-

Reduced dependency on physical cash

-

Faster and easier transactions

-

Enhanced financial transparency

-

Lower operational costs

-

Improved customer satisfaction

-

Greater financial inclusion

-

Safe and secure money transfers

-

Better business scalability

Fintech apps empower individuals and businesses to transition smoothly into a cashless lifestyle.

Conclusion

The cashless economy is the future of global finance. With rapid advancements in digital payments, mobile banking, blockchain, and AI-driven financial solutions, modern fintech applications are essential for supporting secure and seamless financial transactions. By partnering with the right finance app development company and leveraging innovative technologies, businesses can build reliable, scalable, and future-ready financial platforms.

Whether you're developing a mobile wallet, payment gateway, banking app, or AI-driven fintech tool, choosing a trusted technology partner ensures your digital product aligns with industry standards and customer expectations. Fintech innovation is not just transforming payments—it is shaping the foundation of the global cashless economy.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness