Home Insurance Market Size, Coverage Trends, and Industry Outlook

The global Home Insurance Market plays a vital role in protecting homeowners against financial losses arising from natural disasters, theft, fire, and other unforeseen risks. Home insurance policies provide coverage for residential structures, personal belongings, and liability, offering financial security and long-term stability to property owners.

According to Straits Research, rising homeownership rates, increasing awareness about property protection, and growing exposure to climate-related risks are driving market growth. The insurance industry is increasingly adopting digital platforms, advanced risk assessment tools, and customized coverage options to meet evolving consumer needs.

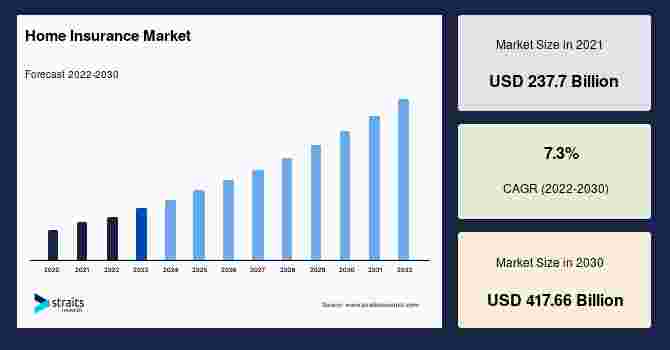

Market Size and Growth Outlook

Market Size 2024 – USD 237.7 billion

Market Size 2033 – USD 417.66 billion

CAGR – 7.3%

The home insurance market is expected to grow steadily during the forecast period, supported by urbanization, rising property values, and increasing demand for comprehensive insurance coverage.

-

Get Your Sample Report Here: https://straitsresearch.com/report/home-insurance-market/request-sample

-

Buy Report Now: https://straitsresearch.com/buy-now/home-insurance-market

-

Download full report https://straitsresearch.com/report/home-insurance-market

Market Drivers

Rising Homeownership and Property Investments

The growing number of residential property purchases across developed and emerging economies is a key driver of the home insurance market. As property ownership increases, so does the need for financial protection against damage and loss.

Increasing Frequency of Natural Disasters

Climate change has led to a rise in natural disasters such as floods, hurricanes, wildfires, and earthquakes. These risks have heightened awareness among homeowners regarding the importance of insurance coverage.

Growing Awareness of Financial Protection

Consumers are becoming more aware of the financial risks associated with property damage and liability claims. This awareness is driving higher adoption of home insurance policies.

Digital Transformation in Insurance Services

The adoption of digital platforms, online policy management, and data analytics has improved customer experience and operational efficiency, supporting market growth.

Market Challenges

High Premium Costs in High-Risk Areas

Homes located in disaster-prone regions often face higher insurance premiums, which may discourage policy adoption among cost-sensitive consumers.

Complex Policy Terms and Coverage Limitations

Lack of transparency and complex policy terms can lead to misunderstandings regarding coverage, reducing customer trust and satisfaction.

Fraudulent Claims and Risk Management

Insurance fraud and inaccurate risk assessment pose challenges for insurers, impacting profitability and operational efficiency.

Market Segmentation Analysis

By Coverage Type

Dwelling Coverage

Dwelling coverage protects the physical structure of a home against damage caused by covered risks such as fire and natural disasters.

Contents Coverage

Contents coverage insures personal belongings within the home, including furniture, electronics, and valuables.

Liability Coverage

Liability coverage protects homeowners against legal and medical expenses arising from injuries or damages occurring on the insured property.

By Policy Type

Comprehensive Policies

Comprehensive policies offer broad coverage, including structure, contents, and liability protection, making them the most preferred option.

Named Peril Policies

Named peril policies cover specific risks listed in the policy and are generally more affordable but limited in scope.

By Distribution Channel

Insurance Agents and Brokers

Agents and brokers play a key role in policy distribution by offering personalized advice and customized coverage options.

Direct and Online Channels

Online platforms and direct-to-consumer channels are gaining popularity due to convenience, transparency, and faster policy issuance.

Top Players Analysis

-

State Farm Insurance

State Farm Insurance is a leading provider of home insurance, offering comprehensive coverage options supported by strong customer service and digital tools. -

Allstate Corporation

Allstate Corporation provides a wide range of home insurance products focused on risk protection and personalized coverage. -

AXA Group

AXA Group offers global home insurance solutions with strong emphasis on digital innovation and customer-centric services. -

Allianz SE

Allianz SE delivers home insurance products supported by advanced risk assessment and global market presence. -

Zurich Insurance Group

Zurich Insurance Group provides property insurance solutions with a focus on risk management and long-term financial protection.

These companies compete based on pricing strategies, coverage flexibility, digital capabilities, and customer service quality.

Related FAQs

What is home insurance?

Home insurance provides financial protection against damage to residential property, personal belongings, and liability risks.

What does a typical home insurance policy cover?

Most policies cover the structure, personal contents, and liability, depending on the coverage type.

What factors influence home insurance premiums?

Location, property value, construction type, and exposure to natural disasters are key premium determinants.

What is the growth outlook for the home insurance market?

The market is expected to grow steadily at a CAGR of 7.3% during the forecast period.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness