Streamlining Salaries: The Ultimate Guide to Payroll Software in India

In the bustling business landscape of India, where startups sprout overnight and enterprises scale at breakneck speed, managing payroll isn't just an administrative chore—it's a strategic imperative. With over 67% of Indian companies already adopting payroll automation as of 2024 (a figure projected to hit 85% soon), it's clear that manual spreadsheets and error-prone calculations are relics of the past. Enter payroll software in India: cloud-based marvels designed to tame the complexities of TDS, PF, ESI, and ever-shifting labor laws. Whether you're a bootstrapped MSME or a multinational giant, the right payroll software ensures timely payments, compliance peace of mind, and happier teams. In this blog, we'll dive into why you need it, what to look for, and spotlight some top contenders—including the innovative TankhaPay.

Why Payroll Software is Non-Negotiable for Indian Businesses

India's payroll ecosystem is a regulatory labyrinth. From calculating gross-to-net salaries amid variable pays and reimbursements to filing quarterly TDS returns (24Q) and navigating state-specific professional taxes, one misstep can trigger penalties or employee discontent. Manual processing? It's not just time-sucking—it's risky. A single deduction error could cost thousands in fines or erode trust.

Payroll software in India flips the script by automating the grunt work:

- Compliance Automation: Handles EPF contributions, ESI filings, and TDS deductions with real-time updates to legal changes.

- Efficiency Boost: Processes bulk salaries in minutes, integrates with attendance and leave systems, and generates payslips via SMS or portals.

- Scalability: Grows with your headcount, from 10 to 10,000 employees, without proportional cost hikes.

- Cost Savings: Reduces HR overhead by up to 110 hours per month, as one Ecotech Services manager reported after switching to a modern tool.

In short, it's not about replacing your HR team—it's about empowering them to focus on talent retention and growth.

Must-Have Features in Payroll Software for the Indian Market

Not all payroll tools are created equal. With regional nuances like Maharashtra's PT slabs versus Karnataka's, your software needs to be India-first. Here's a checklist of essentials:

| Feature | Why It Matters in India | Example Benefit |

|---|---|---|

| Statutory Compliance | Automates TDS, PF/ESI, PT, and gratuity calculations | Avoids fines from delayed 24Q filings |

| Multi-Pay Structure | Supports HRA, allowances, and variable incentives | Handles diverse workforce needs |

| Integration Hub | Syncs with banks, accounting (e.g., Zoho Books), and HRMS | Seamless salary disbursals via NEFT |

| Employee Self-Service | Mobile apps for payslips, leave requests, and claims | Boosts transparency and reduces queries |

| Reporting & Analytics | Custom dashboards for wage audits and forecasts | Informs data-driven decisions |

| Security & Mobility | Cloud-based with role-based access and encryption | Remote access for hybrid teams |

Look for tools with intuitive UIs—no PhD in accounting required. Bonus points for free trials and scalable pricing (often starting at ₹0 for <10 employees).

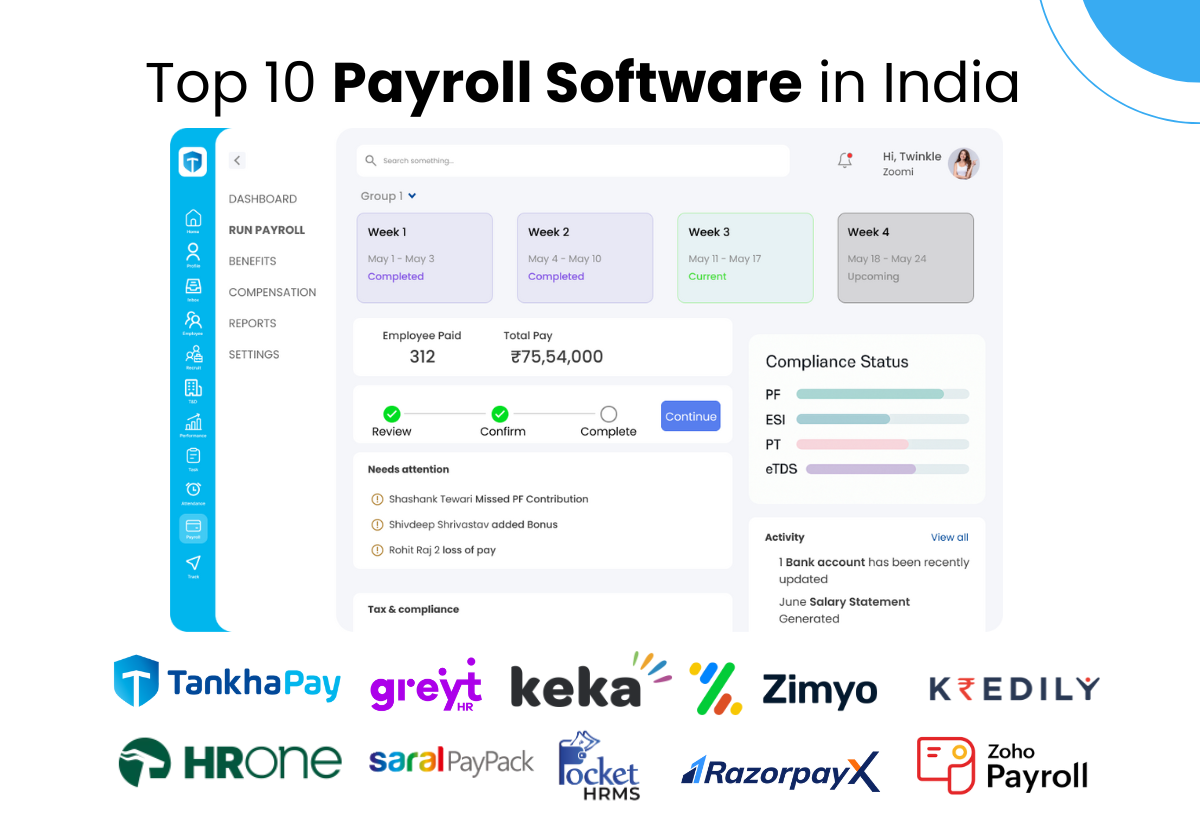

Top Payroll Software Options in India: A Quick Comparison

India's market is flooded with choices, from free starters to enterprise-grade suites. Based on user reviews, compliance prowess, and feature depth, here's a curated list of standouts:

- Zoho Payroll: Ideal for Zoho ecosystem users. Automates bank payouts, leave management, and regional compliances. Pricing: Starts free for small teams; scales affordably.

- RazorpayX Payroll: The compliance king—India's only tool auto-filing TDS, PF, ESI, and PT. With 45+ integrations, it's a startup favorite. Handles instant disbursals to freelancers too.

- SumoPayroll: Free forever for <10 employees. Cloud-hosted with intuitive portals for attendance and deductions. Perfect for bootstrappers ditching Excel.

- Keka: Employee-centric with remote access and SMS payslips. Excels in non-finance HR involvement; user-friendly for all sizes.

- greytHR: Comprehensive end-to-end suite with analytics and onboarding. Trusted for 20+ years; great for midsize firms needing custom reports.

- ADP India: Global muscle with local finesse. Unified HR-payroll platform; won Global Payroll Supplier of the Year in 2022.

- Zimyo: Productivity-focused for SMEs, with tools for attendance and reimbursements. Founded in 2018, it's a rising star in HR tech.

- TankhaPay: A holistic workforce manager (more on this gem below). Blends payroll with EOR services and apprentice compliance—tailor-made for dynamic Indian ops.

Each shines in niches: Razorpay for automation purists, greytHR for depth. Test-drive a few to match your workflow.

Spotlight on TankhaPay: Revolutionizing Payroll for Modern India

Amid this crowded field, TankhaPay emerges as a breath of fresh air—especially for businesses craving an all-in-one HR ecosystem. As India's #1 workforce management app, TankhaPay isn't just payroll software; it's a full-spectrum solution automating everything from attendance tracking to statutory filings.

What sets TankhaPay apart?

- Seamless Automation: Mark attendance via a dedicated employee app, auto-generate payslips, and disburse salaries in self-managed, hybrid, or auto modes. No more "5-click wonders"—it's even faster.

- Compliance Without the Headache: Built-in updates for EPF, ESI, TDS, and labor laws, plus tools for NATS apprentice management and KYC verification.

- Employee Empowerment: A concierge-style helpdesk for PF/ESI queries, plus self-service for onboarding and reimbursements. Employees love the transparency; HRs adore the reduced admin.

- Scalable for All: From startups to large enterprises, it offers EOR (Employer of Record) and managed payroll outsourcing. Customizable to your structure, it slashes processing time while ensuring 100% accuracy.

Users rave about its intuitive dashboard: "TankhaPay turned our monthly payroll maze into a breeze," notes one MSME owner. If you're tired of fragmented tools, TankhaPay's integrated approach—complete with HRMS features—could be your game-changer. Start with their free demo to see the magic unfold.

Wrapping Up: Choose Your Payroll Partner Wisely

In 2025, ignoring payroll software in India is like navigating Mumbai traffic without GPS—possible, but painfully inefficient. With options like TankhaPay leading the charge on holistic, compliant solutions, transitioning has never been easier. Prioritize automation, India-specific features, and scalability to future-proof your operations. Ready to ditch the spreadsheets? Pick a tool, run a trial, and watch your HR woes vanish. Your team—and your bottom line—will thank you.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness